As the retail market landscape has been going through dramatic changes, retailers have engaged head-to-head competition, sometimes with dramatic results. The focus is now on Wal*Mart against Amazon.

Until recently, Amazon was an e-commerce diva whereas Wal-Mart remained the reference for brick-and-mortar shopping.

With Amazon's latest announcement of the intention to acquire Whole Foods and the recent Jet.Com purchase by Wal*Mart, the dominance of the two retail giants of one or the other channel, is about to change.

When Wal*Mart acquired Jet.Com and, later, other online brands, including Bonobos, Moosejaw and ModCloth, the consensus was that it will be going after Amazon's higher-income shoppers. Wal*Mart was poised to bringing the fight to Amazon's turf. Marc Lore, Jet.Com founder and now Wal*Mart executive has been telling media and investors, that the Amazon-WholeFoods deal does not intimidate Wal*Mart.

Investment experts also have been highlighting the need to think twice before jumping to the Amazon-Whole Foods band wagon, at least in the short-term.

However, it is usually actions in the short term that determine how current opportunities may become major wins, in the future.

The line in sand started to appear last year when Wal*Mart bought Jet.com for $3 billion. Amazon had to do something, and something big. That is perhaps why, On Friday, Amazon.com answered Wal*Mart challenge with the $13.7 billion purchase offer to Whole Foods Market. The consensus is that stakes appear highest for Wal*Mart. But, it is ignoring the power of the two giants.

First, on fundamentals. Wal*Mart reported $6.9 billion in cash and equivalents and $20.9 billion in free cash flow on Jan 31, 2017, the end of Wal*Mart fiscal year.

Amazon, on the other hand, reported $12.5 billion in cash and equivalents and a free cash flow of $10.2 billion on March 31, 2017, the end of Amazon fiscal year.

Hence, both companies have the means to make acquisitions and to invest in a long term strategy to leverage these acquisitions.

In the end, it may all sum up to who is best at coming up with technologies to improve the consumer shopping experience, focusing on segments that matter the most, and offering products that matter at the right price.

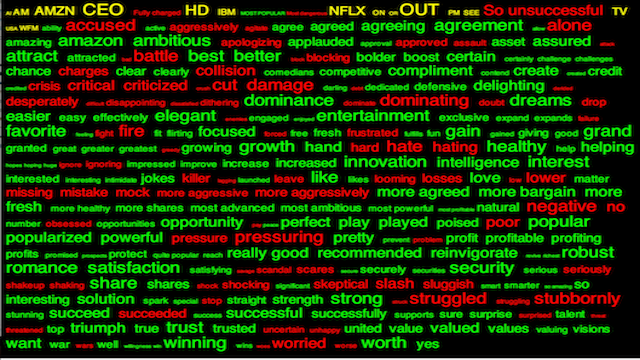

Meanwhile, Whole Foods stock has jumber to above the offering price of $42.00 a share, signaling that investors may be speculating that a rival offer for Whole Foods may be in works. Some are speculating that Wal*Mart may even be considering an offer, of it own. AroniSmart Invest In Action has already flagged the heated interest on Wal*Mart (NASDAQ: WMT) , Whole Foods (WFM) and Amazon (AMZ) (see attached Sentiment cloud network.