On April 19, 2021, the stock market sentiment remains positive. However, investors appear to have started focusing on one of the key questions: what is coming next? The answer to the question remains elusive, especially after the up and down movements, around an overall upward trend, observed since the beginning of the year. In the previous analyses, AroniSmart™ team has shown major positive signs at the start of Q2 2021, looking at the volatility dynamics observed in March and February 2021, (see some dynamics here: AroniSmartInvest™ in Action: Key Stocks on April 2, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses)

On April 19, 2021 the stock market performance appears to be impacted by factors similar to those that were driving the volatility as of April 2, 2021: speculative considerations on the economy, profit taking, bonds prices, interest rates, options trading, political agenda, and related news about some key stocks, especially those related to Electic Vehicules (EV) Technology, Solar Energy, Cryptocurrency, Retail, and Banking.

As of the closing hour of April 16, 2021 the key stock market indices continued to register gains ( Dow Jones Industrial Average gained 1.49%, Nasdaq 1.59 %, S&P 500 2.063%). AroniSmart™ team, leveraging the Machine Learning, Big Data, Bayesian Network Analysis, Neural Network Analysis, Text Analytics and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™, and AroniSmartIntelligence™ looked at the stock performance, market sentiment index and events driving the stock market in April 2021 ( For More on AroniSoft LLC and AroniSmart products click here).

AroniSmart™ team continues to build on earlier analyses in 2021. The analyses reinforce the fact that the market sentiment remains in the negative territory, as investors appear to continue struggling with uncertainty and volatility and both upbeat and downbeat expectations. At the same time, there is growing confidence following the clearing views about the direction of the market, as the crisis is being addressed by political and economic decision makers.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

A little bit of the insights on the market events and sentiments, from AroniSmart™ team's findings, based on the data as of April 19, 2021.

AroniSmart™ team analyzed the key stories, leveraging the Machine Learning, Big Data Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™ and uncovered actionable insights..

General Market Events and Sentiments

Reversing the April 2, 2021 trend, the Market Sentiment is turning more positive across several sectors and sites. The news about cryptocurrencies and crowd investments continue to drive sentiment positivity. The sectors that had negativity in late Q1 2021 and early April 2021 and that have started to turn to positive sentiment include Retail, Travel, and Banking. However, mostly bonds, Chips, and EV related news remain in negative areas ( average positivity < 50%). The analysis highlights multiple dynamics, for the stock profile, the segmentation of stocks, the market profile and the sentiment in general.

AroniSmartIntelligence™ Analysis of Positive and Negative Sentiment words.

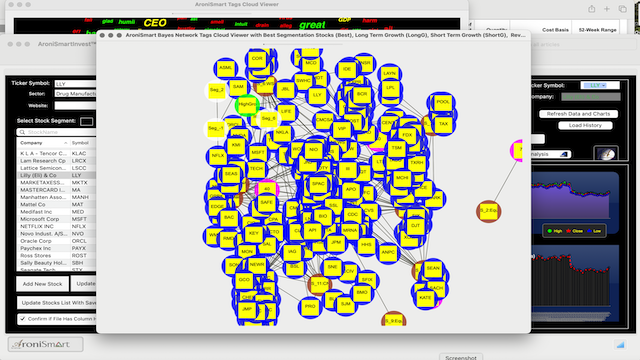

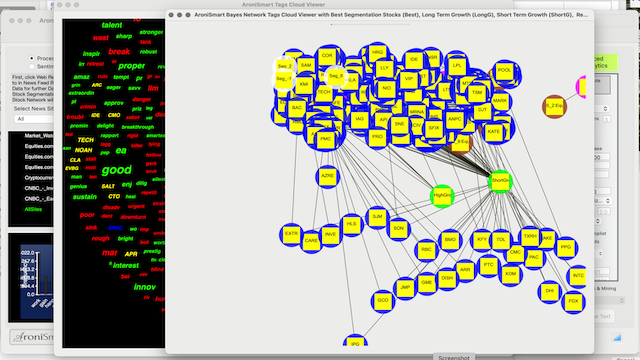

The key stocks tickers, with high overall index in the AroniSmartInvest Tags word cloud and Bayesian Network analysis and , as of April 19, 2021 are shown in the Bayesian Network and Sentiment Analysis below.

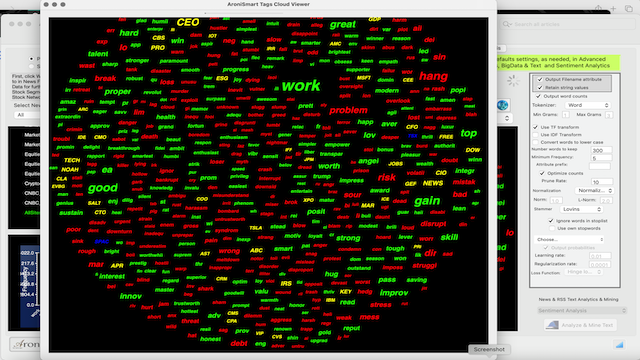

From the figure above, it appears the IRS, APR, WORK, GAIN, and JOBS tag are prominent, highlighting the dominance of news about Tax Filing and Returns, interest rates, employment. As expected, Retail, Tech and Healthcare stocks and news related word tags remain dominant.

As depicted in the Words Cloud and Tags view above, it was found that the the positivity (see words in green) continues to be driven by words such as health, work, good, proper, gain, improv, innov, interest, gain, relief, strong, etc. The words cloud points to the improving companies earnings, healthcare, the performance of the stock market, COVID-19 vaccinations, new innovations such as EV and 5G, Solar Energy, and the continued government support to improve economic performance.

The negativity appears to come from the market volatility, risk, rough, debt, and job market, and overal challenges related to struggling businesses while trying to overcome and go past the crisis.

AroniSmartInvest™ in Action: Segmentation and Key Stocks Driving the Market Sentiment

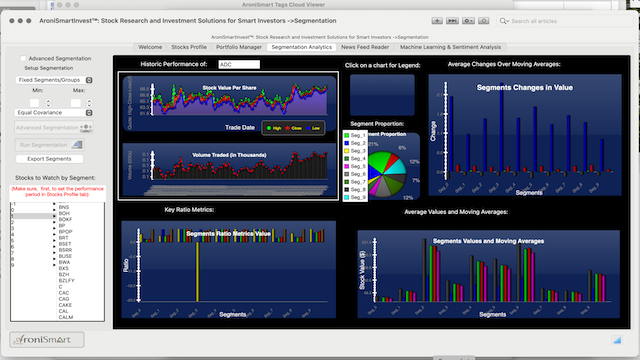

The stock analysis builds on earlier trend and now show that the sectors driving the markets include TECH, EV, Retail, Banking, and Healthcare. Airline transportation had started to appear with an increasing momentum in previous analyses. It is now well established in the current analysis. In the current analysis, the optimal segmentation analysis has kept the 10 segments with different performance, in terms of technicals and fundamentals (see below).

The list of stocks highly impacted on April 18, 2021 has varied since the last analysis, but Apple (AAPL), MicroSoft (MSFT), Johnson & Johnson (J&J), Tesla(TSLA), Moderna(MDNA), Oracle(ORCL), Bank of Ameica (BAC), CVS (CVS), etc... continue to drive the market and appear in the analysis. The Bitcoin and EV stocks also continue to play a major role. The figure below shows a sample of stocks in news in the High Growth and Short Term Growth groups, accross all the 10 identified segments, mostly mentionned in the news on April 18 & 19, 2021.

More detailed analyses, including stock segmentation and profile analysis can be conducted using Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities of AroniSmartInvest and AroniSmartIntelligence™.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

@2021 AroniSoft LLC

For More on AroniSoft LLC andAroniSmart products click here