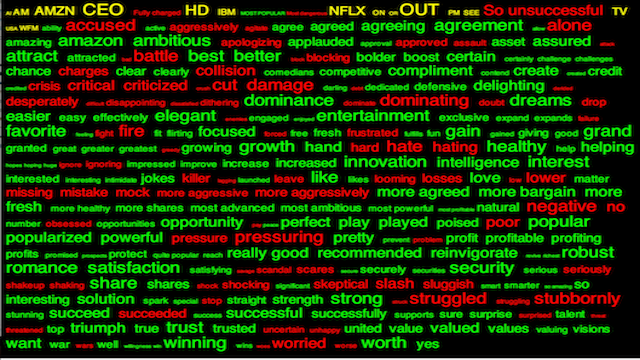

On Tuesday May 30, 2023, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends. Since the beginning of the year, the stock market has been volatile, with seesaw movements driven by the news around the world, the fears of recession, the resilience or weaknesses of some sectors, the inflation worries, Ukraine wars, Chinese companies, and economical forecasts. From the analysis, the team came up with insights and highlights on key stocks and market sentiments. Below are the key stocks highlighted and expected to weight heavily in investment decisions at the end of Q2 2023 and the associated sentiment analysis results.

Aroni in Action

AroniSmartInvest™ in Action: Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses Uncovers Key Stocks Leading to the Week of June 14, 2021

On May 19, 2021, the stock market sentiment had started to head towards negativity, after a long period of positivity. Almost a month later, the sentiment continues to lean towards negativity. As of the closing hour of June 11, 2021 the dynamics of the stock market remain complex and the sentiment neutral or negative.

AroniSmartInvest™ in Action: Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses Uncovers Key Stocks on May 19, 2021

On May 19, 2021, the stock market sentiment has started to head towards negativity, after a long period of positivity. In the analysis conducted by AroniSmart™ team on April 30, 2021, investors appeared to have started finding direction and answers on one of the key questions the market actors were facing: what is coming next? Although the answer to the question remained elusive, there appeared to be a growing consensus on where the market was heading, following the up and down movements, around an overall upward trend, observed since the beginning of the year. While the overall upward trend was observed since the beginning of the year, by late-April the trend has shifted downward. As of the closing hour of May 19, 2021 the dynamics of the stock market were different.

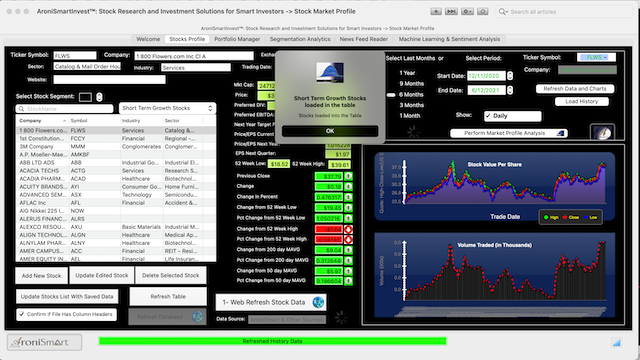

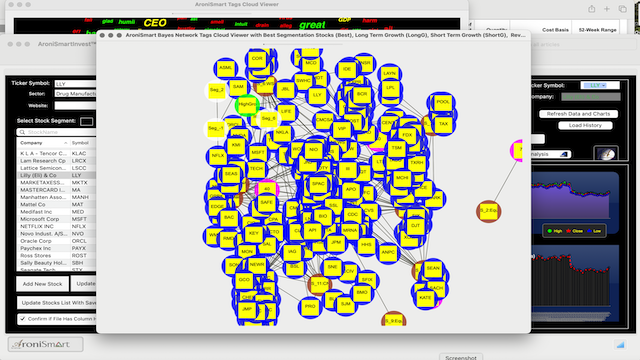

AroniSmartInvest™ in Action: New Trends and Key Stocks on April 30, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses

On April 30, 2021, the stock market sentiment remains positive and new trends are already showing. Investors appear to have started formulating scenarios for the future as they are tryig to find answers the key questions highlighted in AroniSmart latest analyses: what is coming next? Although the answer to the question remains elusive, there is growing consensus on where the market may be heading, following the up and down movements, around an overall upward trend, observed since the beginning of the year.

On April 30, 2021 the stock market performance appears to be impacted mostly by earnings and the latest economic agenda published by the US President Joe Biden in his national address marking his 100 days in office. Still, other by factors remains: speculative considerations on the economy, profit taking, bonds prices, interest rates, options trading, and related news about some key stocks, especially those related to Electic Vehicules (EV) Technology, Solar Energy, Cryptocurrency, Retail, and Banking. One may also add Transportation and Tourism, as Summer approaches and COVID-19 vaccines have reached the majority of adult Americans and improving in other countries.

AroniSmartInvest™ in Action: Key Stocks on April 19, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses

On April 19, 2021, the stock market sentiment remains positive. However, investors appear to have started focusing on one of the key questions: what is coming next? The answer to the question remains elusive, especially after the up and down movements, around an overall upward trend, observed since the beginning of the year. In the previous analyses, AroniSmart™ team has shown major positive signs at the start of Q2 2021, looking at the volatility dynamics observed in March and February 2021, (see some dynamics here: AroniSmartInvest™ in Action: Key Stocks on April 2, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses)

On April 19, 2021 the stock market performance appears to be impacted by factors similar to those that were driving the volatility as of April 2, 2021: speculative considerations on the economy, profit taking, bonds prices, interest rates, options trading, political agenda, and related news about some key stocks, especially those related to Electic Vehicules (EV) Technology, Solar Energy, Cryptocurrency, Retail, and Banking.

AroniSmart In Action: Amazon, Wal*Mart, and Whole Foods or the Battle of Giants to Dominate the Retail Market

As the retail market landscape has been going through dramatic changes, retailers have engaged head-to-head competition, sometimes with dramatic results. The focus is now on Wal*Mart against Amazon.

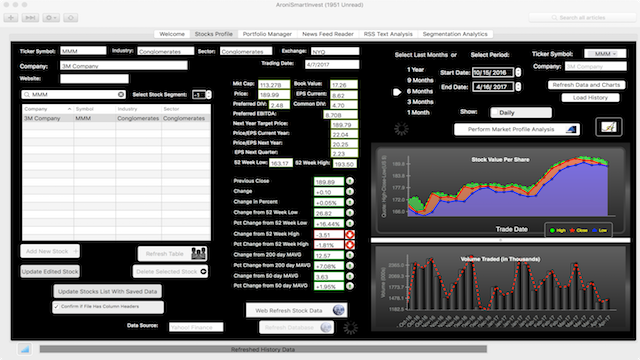

A few stocks picked by AroniSmartInvest in Action™ to watch in Q2 2017

As Q2 2017 starts, AroniSmartInvest In Action™ picked a few stocks to watch. Based on its proprietary advanced analytics, and despite the roller coaster of emotions in the market, AroniSmartInvest™ In Action picked a few promising stocks.