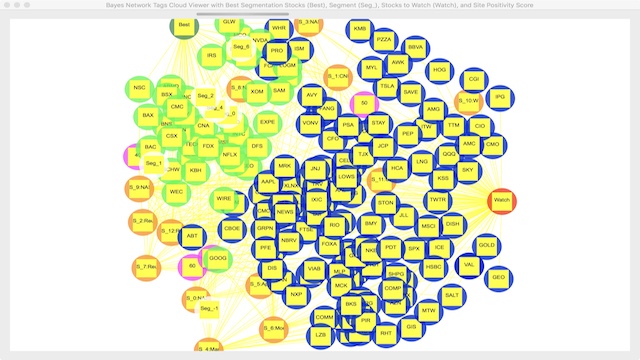

On October 6, 2018, AroniSmartInvest in Action predicted that Twitter’s stock (NASDAQ: TWTR) will have a momentum in Q4 2018. AroniSmartInvest In Action made the projections after Twitter stock had increased by 86%, reaching $46.80 in July 2018, from $22.04 in Jan 2018. It was then down 36% over the past three months, back to $28.39.The projections were based on several factors likely to fuel the momentum

Twitter: Security, Mobile, User Engagement, AI and Mid-Term US Elections

In the latest Q3 2018 earnings report, Twitter sales grew 29% to $758 million YOY, beeating analysts' expectations of $701 million. Net income was $789 million or $1.02 a share vs. a loss of $21 million a year ago. Twitter reported adjusted earnings of 21 cents a share, beating the FactSet earnings consensus of 14 cents. Taking into account a "one-time release of deferred tax asset valuation allowance" of $683 million, Net Income was $106 million.

Hence, the factors that AroniSmartInvest in Action predicted are in action.

First, the changes made to address the safety and privacy issues faced by social media in general, combined with a best use of Artificial Intelligence (AI) led to a drop of more than 1 million fake accounts over Summer. The number or monthly users is now at 326 millions. However, with the fake accounts removed, the remaining accounts are more engaged, according to Twitter CEO Jack Dorsey.

Second, the upcoming mid-term elections in the US have also increased traffic and engagement. Although Twitter does not disclose the specific number of daily users, the number grew by 9% vs. year ago, mostly due to switches to Mobile from Desktop. The switch is expected to increase engagement even further. As the mid-term elections have heated up in Q4 2018, there is mounting signs that more engaged users and the latest efforts by politicians, activists and media by leveraging Twitter to focus electors and the public on events and candidates will bring in more revenues in Q4 2018, and hence lift the stok even further.

In preparation for the elections, Twitter had been investing heavily in product improvements, artificial intelligence, and nimble sales support. The latest quarterly earnings report have already pushed the stock upward, up to $32.26 or 16%.

The Q4 2018 earnings will add fuel the momentum.In fact, for the next quarter, Twitter projects adjusted EBITDA between $320 million and $340 million.