The end of Summer 2021 is comming with new trends in the stock market. In the first week of September 2021, prices of key stocks have stayed near record highs. At the same time, volatility continues to increase and the market sentiment is gradually shifting to negative territories. The stock market dynamics appear to continually balance the factors that have affected the overal market since early 2021, such as COVID-19 pandemic new waves, the complex job market, the growing inflation, Chinese government actions on Tech, e-commerce companies, a new stock market, and electric vehicles, the end of the US unemployment benefits, and the overall US economic policies.

On September 5, 2021, the key stock market indices, while near record performances and almost flat vs the week before, ended with a mixed view (Dow Jones Industrial Average lost: -0.21%; Nasdaq gained: + 0.21 %; S&P 500 lost: - 0.03%, and Russel 2000 lost: -0.52%). AroniSmart™ team, leveraging the Machine Learning, Big Data ,Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™ and AroniSmartIntelligence™, looked at the stock performance, market sentiment index and events driving the stock market as the end of Summer 2021 approaches ( For More on AroniSoft LLC and AroniSmart products and Terms and Contacts, click here). Key stocks driving the market at as of September 5, 2021 were identified.

AroniSmart team has continued to build on earlier analyses conducted in 2021( see AroniSmartIntelligence™ in Action: Apple (AAPL) Stock Performance and Momentum Analysis with Support Vector Machine and Dominance Analysis in Q3 2021). AroniSmart™ team's analyses show that the market sentiment remains balanced, driven by increasing uncertainty and volatility, high earnings, US economic policies, and international markets concerns.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

A little bit of the insights on the market events and sentiments, from AroniSmart™ team's findings, based on the data as of September 5, 2021.

AroniSmart™ team analyzed the key stories and news on the stock markets, leveraging the Machine Learning, Big Data Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™ and uncovered actionable insights.

General Market Events and Sentiments

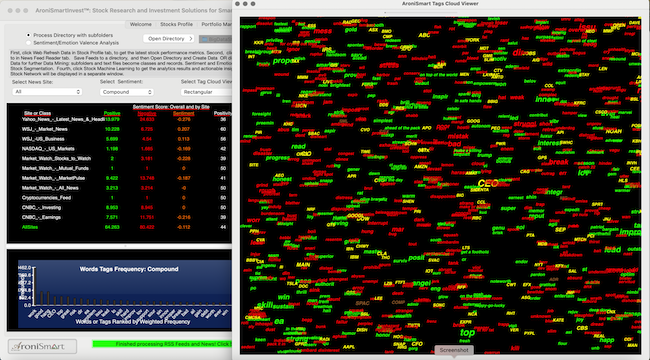

In general, the market sentiment is turning negative. The sentiment on stock related news has declined to negative areas, with average positivity now at 44%. Hover some areas, sectors and sites still present a positive picture (positivity > 50%), especially in news related to US markets, investing, EV, and the crypocurrency. AroniSmart analysis cleary identifies multiple dynamics, including in the stock profiles, the segmentation of stocks, the market profile and the sentiment in general. Although the market sentiment has some areas with general positivity trends, it has shifted to increasing negativity due to uncertainty and mixed positions.

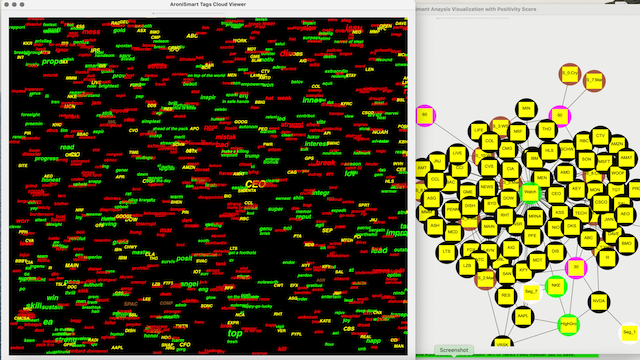

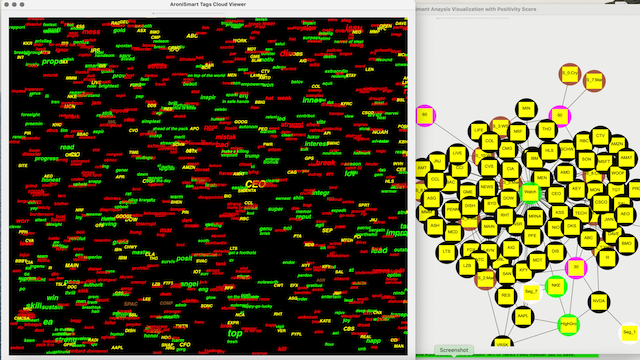

The key stocks tickers, with high overall index in the AroniSmartInvest Tags word cloud and Bayesian Network analysis and , as of September 5, 2021 are shown in the Bayesian Network and Sentiment Analysis below.

Figure 1: Stocks to Watch and Sentiment Analysis as of September 2, 2021

AroniSmartIntelligence™ Analysis of Positive and Negative Sentiment words.

As depicted in the Words Cloud and Tags view below, the positivity (see words in green) is driven by words such as saving, empowerment, modern, won, super, skill, propel, interest, gain, earnings, relief, boost, boom, bolster, support, upbeat, uphold, top, improve, enthusiam, smart, smooth, oustmart, etc. The words point to the performance of the stock market, new innovations, and the continued government support to improve economic performance.

The negativity appears to come from the volatility, prohibition, interruption, debt, risk, mistakes, mess, inflation, bonds market, and overal uncertainty pointing to expected challenges in the stock markets and from international economic policies.

Figure 2: Words Cloud and Sentiment Analysis as of August 27, 2021

AroniSmartInvest™ in Action: Key Stocks Driving the Market Sentiment

Based on AroniSmart™ team's analysis, it was found that most sectors or industries continue to persistently drive the market. However, Technology, Auto Manufacturers/EV, Entertainment, Consumet Defensive, Home Improvement Retail, Transportation, Financial Services, and Healthcare . The previous analyses showed a strong and steady momentum. In the current analysis, the trends remain mainly postive.

The stocks highly active on September 5, 2021 as shown in the figure below. As a sample, the chart includes the following tickers as some of the most active of the week:

AMZN, AAPL, NFLX, GOOG, FB,MSFT, NVDA, AMD, AMGN, PYPL, ASML , ADBE, INTU, MRNA, PFE, AMAT, TEAM, TGT, WMT, LOW, HD, PEP, AVGO, COST, MKNG, MELI, ZM, LRCX, ADBE, INTC, MTCH.

Figure 3: Active stocks to watch based on AroniSmart Sentiment Analysis as of September 2, 2021.

More detailed analyses, including stock segmentation and profile analysis can be conducted using Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities of AroniSmartInvest and AroniSmartIntelligence™.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

@2021 AroniSoft LLC

For More on AroniSoft LLC andAroniSmart products click here