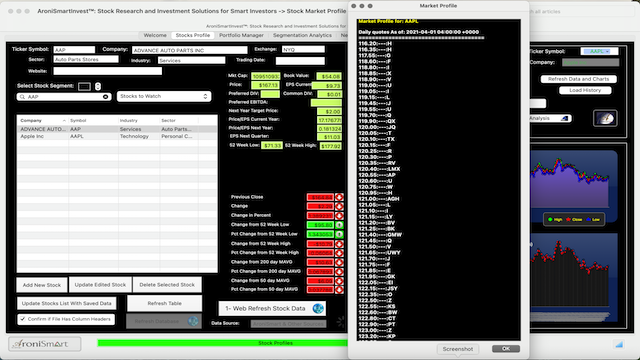

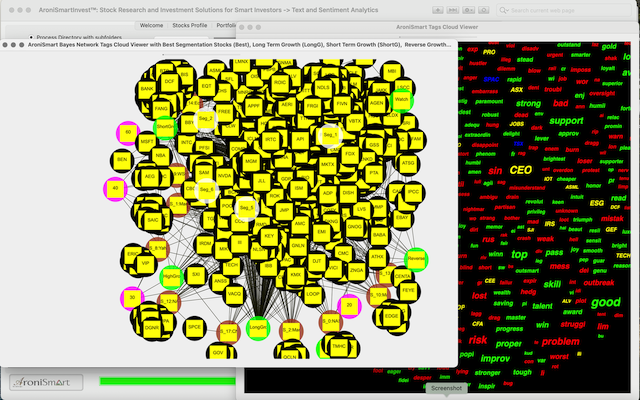

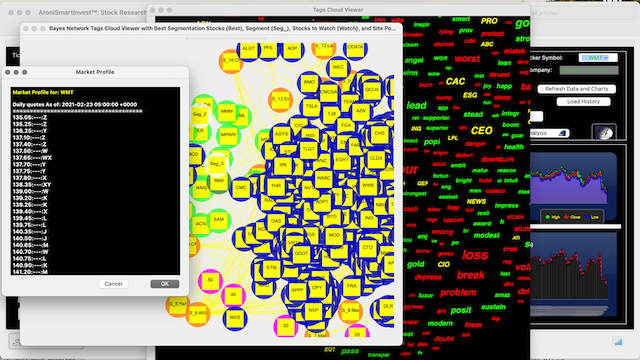

AroniSmartIntelligence Stock Market Indices Time Series Support Vector Machine, Neural Network and NLP Sentiment Analysis

In the market analyses over the year 2023 , AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, has been looking at the stock markets news and trends since Q1 2023. Since the beginning of the year, the stock market has been volatile, with seesaw movements driven by the news around the world, the fears of recession, the resilience or weaknesses of some sectors, the inflation worries, Ukraine wars, Chinese companies, and economical forecasts. From the analyses, the team has been coming up with insights and highlights on key stocks and market sentiments. The latest analysis has focused on the dynamics and trends at the start of Q3 2023. Below are the key stocks highlighted and expected to weight heavily in investment decisions in Q3 2023 and the associated sentiment analysis results.