Fall 2021 started with a rebound amid seesaw dynamics in the US Stock Markets. As expected, as Fall approached, the stock market momentum that started in early May 2021 had been slowing down, with the increasing volatility and major impact of unexpected news. The factors that have affected the overal market since early 2021, such as COVID-19 pandemic new waves, the job market, the growing inflation, Chinese government actions on Tech and e-commerce companies, and the overall economic policies appear to have finally caught up with the market. These factors appeared to be the driver of the observed sell-offs. Then two major events happened: unexpected negative news on China Evergrande Group and encouraging news from the US FedReserve meeting.

AroniSmart™ team, leveraging the Machine Learning, Big Data, Data Science, Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™ and AroniSmartIntelligence™, looked at the stock performance, market sentiment index and events driving the stock market as of September 23, 2021 ( For More on AroniSoft LLC and AroniSmart products click here). The key stocks driving the market at the end of Summer 2021 were identified.

On September 19, 2021, news emerged about the China's heavily-indebted Evergrande Group. According to the news, Evergrande was due to pay $83.5 million in interest on a dollar-denominated bond and additional significant funds on a yen-denominated bond. News pointed to a potential default for both bonds. Following the news on Evergrande, the key stock market indices registered heavy losses, adding to previous growing sell-offs after weeks of record performances (Dow Jones Industrial Average (^DJI) lost 3.21%, Nasdaq (^IXIC): 3.33 %, S&P 500(^GSPC): 2.93%, and Russel 2000 (^RUT) lost 3.40%).

Then on Wednesday, September 21, 2021, the meeting of the US Federal Reserve Bank was held. In the meeting, key major plans and signals were announced, including shifting away from the pandemic financial support and rolling back the related stimulus and potential actions related to bonds and interest rate. By the end of the day on Thursday, September 23, 2021, the stock market was back to near records highs. Compared to the week before, the stock performance was back to near record territories, with gains across the board: Dow Jones Industrial Average (^DJI): +0.67%; Nasdaq (^IXIC): +0.38 %; S&P 500 (^GSPC): +0.15%; and Russel 2000 (^RUT): +1.82%).

AroniSmart team has continued to build on earlier analyses in 2021( see AroniSmartInvest™ in Action: Summer 2021 Approaching End with Declining Sentiment as Key Stock Prices Continue to Soar; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses). AroniSmart™ team's analyses show that the market sentiment across all sectors and areas, except for cryptocurrencies and IPOs, has fiinally declined to negative territories, driven by increasing uncertainty and volatility, sell-offs, US economic policies, and international markets concerns.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

A little bit of the insights on the market events and sentiments, from AroniSmart™ team's findings, based on the stock and news feeds data as of September 23, 2021.

AroniSmart™ team analyzed the key stories and news on the stock markets, leveraging the Machine Learning, Big Data, Data Science, Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™ and uncovered actionable insights.

General Market Events and Sentiments

In general, the negativity of the Market Sentiment has increased across several sectors and sites, driven by news related to the stock market and September/Early Fall dynamics, the inflation, the political negotiations on budgets, international markets dynamics, and the pandemic. The sentiment on stock related news has declined to negative areas across the board( average positivity now around 35%). The analysis cleary identifies multiple dynamics, for the stock profile, the segmentation of stocks, the market profile and the sentiment in general. Although the market sentiment has some areas with general positivity trends, it has reached significan levels of negativity due to uncertainty and mixed positions.

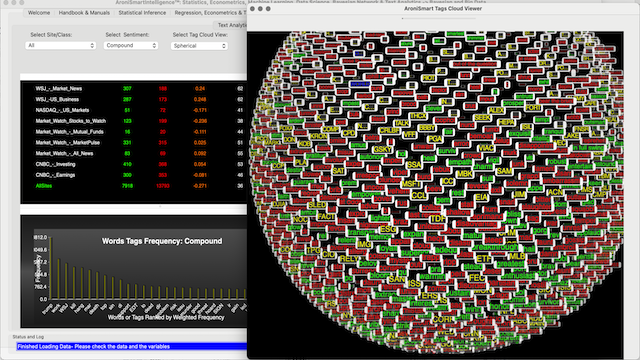

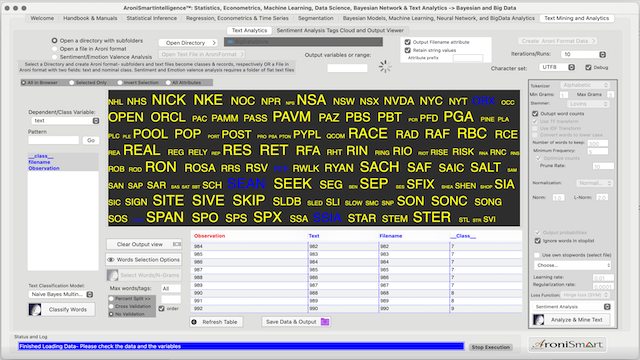

The key stocks tickers, with high overall index in the AroniSmartInvest Tags word cloud and Bayesian Network analysis, as of September 23, 2021 can be uncovered leveraging the Bayesian Network and Sentiment Analysis of AroniSmartInvest and AroniSmartIntelligence.

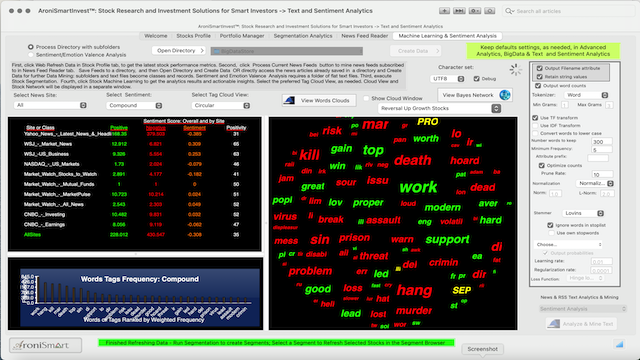

Figure 1: Stocks to Watch and Sentiment Analysis as of September 23, 2021

AroniSmartIntelligence™ Analysis of Positive and Negative Sentiment words.

As depicted in the Words Cloud and Tags view above and below (Figure 1 and Figure 2), the positivity (see words in green) are driven by words such as work, support, hot, hard, top, popl, modern, interest, gain, support, upbeat, win, great, lead etc. The words point to the performance of the stock market, new innovations, and the job market.

The negativity appears to come from the volatility, potential social issues and humanitarian crises and overal uncertainty on the new waves of the COVID-19 pandemic, international markets especially news from China and immigration crises.

Figure 2: Words Cloud and Sentiment Analysis as of September 23, 2021

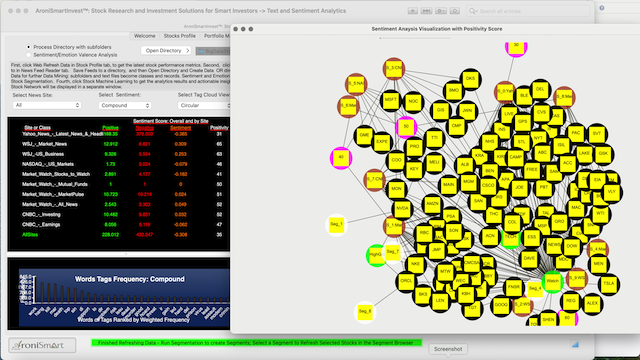

AroniSmartInvest™ in Action: Key Stocks Driving the Market Sentiment

Based on AroniSmart™ team's analysis, it was found that most sectors have been impacting the latest dynamics in the markets, most importanly TECH, Oil, Travel and Resorts, Transportation, Retail, and Healthcare. Some sectors have negative impact while others, such as TECH and Healthcare, appear to have mixed effects, with a combbination of a strong and steady momentum and sell-offs.

A sample of stocks highly active on September 23, 2021 are shown in the figures below:

Figure 3-a: Active stocks to watch based on AroniSmart Sentiment Analysis as of September 23, 2021: Sample Ticker symbols T-X

Figure 3-b: Active stocks to watch based on AroniSmart Sentiment Analysis as of September 23, 2021: Ticker symbols from A

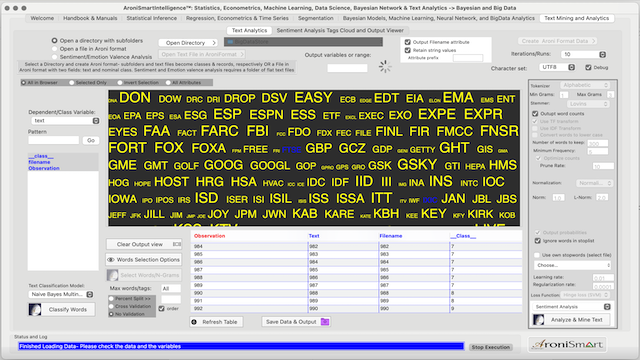

More detailed analyses, including stock segmentation and profile analysis can be conducted using Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities of AroniSmartInvest and AroniSmartIntelligence™.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

@2021 AroniSoft LLC

For More on AroniSoft LLC andAroniSmart products click here