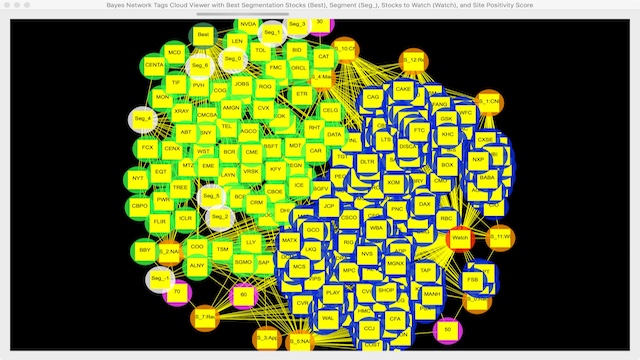

On Sep 1, 2017, AroniSmartInvest In Action™ picked, leveraging the proprietary advanced Text and Sentiment Analytics, Stock Segmentation, and Machine Learning, a few promising stocks to watch over September 2017. Below is a quick overview of some of these stocks, with a focus on the information in news, social media, and other sources leveraged by AroniSmartInvest machine learning and stock segment module:

- FCX: Freeport-McMoRan Inc.. (NYSE: FCX).Freeport-McMoRan Inc. (FCX) is a mining company, operating in copper, gold and molybdenum prospecting, mining, and selling. Several hedge funds have recently raised their stake in shares of Freeport-McMoran, Inc. in the 2nd quarter, according to the most recent Form 13F filing with the Securities & Exchange Commission.

- NYT:The New York Times Company.. (NYSE:NYT) The New York Times Company is a media company. It has recently benefited from the coverage of the politics in the US. The prominent ficus on NYT reporting has pushed the stock higher. In recent trading, shares of New York Times Co. crossed above the average analyst 12-month target price of $18.67, to reach $18.85 per share. If the focus remains on NYT, the stock may continue to go higher. Otherwise, the stock could face a correction.

- AAPL: Apple Inc. see AroniSmartInvest in Action.

- MON: Monsanto Company. (NYSE:MON)Monsanto Company (Monsanto), along with its subsidiaries, is a provider of agricultural products for farmers. Bayer an all cash $66 Billion acquisition of Monsanto Deal expected to close in early 2018, with $128.00 per share, or ~10% premium.

- POW: Power Corporation of Canada (NYSE:POW is a diversified international management and holding company primarily operating in the financial services, communications, and other business sectors in Canada, the United States, and Europe. With a market capitalization of $11.67 Billion, it has consistently returned an average of 4.15% per year over the last 10 years. .

- WMT: Wal*Mart (NYSE: WMT) sales get boost from online growth, customer visits. The pick up in shopping activity, boosted by its e-commerce presence, is expected to fendoff stiff competition, in the short term. Its E-commerce grew at an impressive 63% YOY this quarter in the U.S., a significant improvement from 29% last quarter and 21% in fiscal 4Q17.

- FLIR: FLIR Systems, Inc. (NYSE:FLIR) designs, develops, markets and distributes thermal imaging systems, visible-light imaging systems, locater systems, measurement and diagnostic systems and threat-detection solutions, used in surveillance, security, and detection. Eagle Asset Management Inc. recently grew its stake in shares of FLIR Systems, Inc. by 253.7% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission.

- ICLR: ICON public limited company (NYSE:ICLR) is a contract research organization (CRO), which is engaged in providing outsourced development services to the pharmaceutical, biotechnology and medical device industries. Most major investment research companies have upgraded the stock and a number of hedge funds have recently bought and sold shares of ICLR. ICON PLC had a return on equity of 28.72% and a net margin of 15.97%.

- MCOR Group, Inc. (NYSE: EME) is an electrical and mechanical construction, and facilities services firm operating in the United States.

- ABT: Abbott Laboratories (NYSE: ABT)is engaged in the discovery, development, manufacture and sale of healthcare products. Several hedge funds recently made changes to their positions in the company, according to the most recent 13F filing with the SEC.

- SNY: Sanofi (NYSE: SNY).is a healthcare company engaged in the research, development, manufacture and marketing of therapeutic solutions. Grandfield & Dodd Llc has recently increased its stake in Sanofi (SNY) by 54.96%, based on the latest 2016Q4 regulatory filing with the SEC. Although Sanofi has faced patent expirations on two of its top-selling drugs, Lantus for diabetes and Plavix for the prevention of blood clot, along with legal challenges on its cholesterol lowering drug Praluent, the strong demand for its multiple sclerosis drugs and cost-cutting programs have shown positive results.

- CMCSA: Comcast Corporation (NYSE: CMCSA) is a media and technology company, with two primary businesses: Comcast Cable and NBC Universal. Major equities research analysts, including Bank of America Corporation, recently issued reports with buy rating.

- FMC: FMC Corporation (NYSE:FMC) is a diversified chemical company serving agricultural, consumer and industrial markets. FMC Corporation stock has recently hit maximum technical strength and broken out to a five bull momentum rating. This may be a sign of overbuying into the stock and perhaps a sign of an upcoming correction, but the momentum appears to be gaining strength.

- ORCL: Oracle Corporation. (NYSE:ORCL) provides products and services that address all aspects of corporate information technology (IT) environments, including Software as a Service (SaaS) and Platform as a Service (PaaS) offerings. Since issuing a solid Q4 earnings report, Oracle stock has traded around the $50 handle. The views on the stock trend appear mixed, with more towards a bullish sentiment.

- ADBE: Adobe Systems Incorporated. (NYSE:ADBE) is a software company, operating through three segments: Digital Media, Digital Marketing, and Print and Publishing. It offers data management platforms to small and large companies to help them create, manage, execute, measure and optimize theis digital advertising and marketing. Equities analysts have a recently issued reports about Adobe Systems stocks with a ratings from “buy” or “strong-buy” rating.

- CVX: Chevron Corporation (NYSE:CVX) ngages in integrated energy and chemicals operations in US and internationally. The State of Wisconsin Investment Board has recently increased its position in shares of Chevron Corporation by 12.4% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. Other hedge funds and institutional investors have also increased their holdings.

Disclaimer: AroniSmart Team members and/or AroniSoft LLC have investments in the following stocks: MON and AAPL and may buy other stocks mentionned in this article in the short term.